Last year the Chancellor Rishi Sunak proposed increasing corporation tax rates such that companies with annual profits of over £250,000 would pay tax at 25%. Those with annual profits of less than £50,000 would continue to pay tax at 19% but a marginal tax rate of around 26.5% would apply on profits between £50,000 and £250,000.

The new Chancellor Kwasi Kwarteng has decided to keep the main rate of corporation tax at 19% at all profit levels. This will certainly keep corporation tax calculations simple and benefit profitable companies with higher profits.

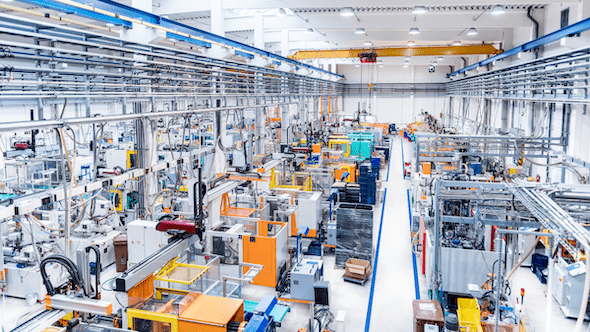

Companies can currently claim a super deduction of 130% of the cost of new equipment purchased before April 2023. This deduction is likely to be modified or scrapped as it was introduced to encourage companies to invest before the corporation tax rate increased to 25%.

Instead businesses will be encouraged to claim under the annual investment allowance (AIA) which gives 100% relief for the cost of any qualifying equipment whether it was purchased new or second hand. The AIA can cover purchases totalling up to £1m per year and this cap will now be kept at that level indefinitely.