Experts urge businesses to beware of latest VAT changes

Business owners registered for VAT are being reminded to make sure they file their returns and pay on time or face falling foul of new penalties introduced by HMRC.

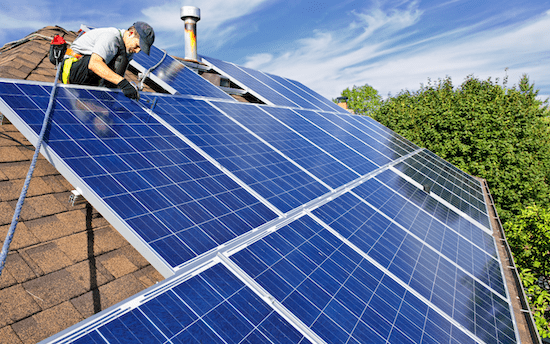

VAT on energy saving materials

The zero rate of VAT has been extended to include the installation of additional energy-saving materials (ESMs) from 1 February 2024.

VAT registration threshold raised

Effective from 1 April 2024, the taxable turnover above which a business is required to register and account for VAT will be increased from £85,000 to £90,000.

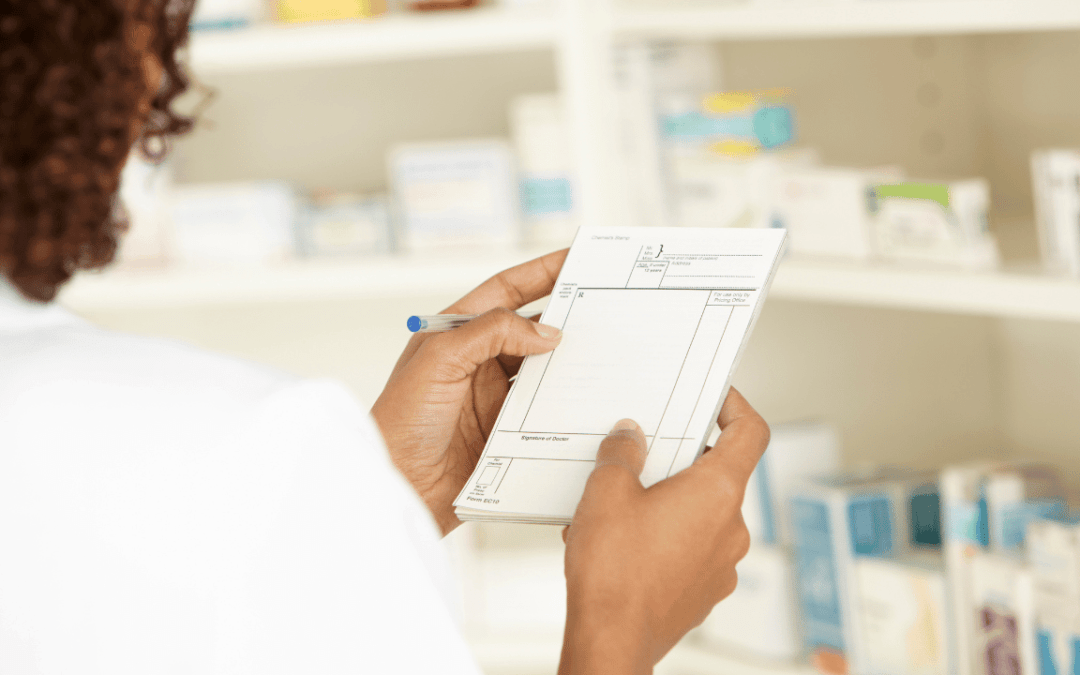

VAT on work in pharmacies

From 1 May 2023 medical services can be VAT exempt if they are performed by a person who is not a registered health professional but who is directly supervised by a pharmacist.