Firm news

News

Firm news, tax planning and finance blogs by our team

We know how important it is for you to be able to find up to date business information, and our people love to share their knowledge about the news, and accounting and tax legislation. Here you will find links to our latest press releases, as well as tax planning and finance blog posts – all written by the Whitley Stimpson team, so you can read our take on topical subjects, and use our advice to help you to run your business. We have also shared the odd blog post or two about what we get up to in our communities, because we are proud to be a part of the areas where we live and work, and to support them where we can.

Join in the conversation, we would love to hear from you.

Update on the Self-Employed Income Support Scheme (SEISS)

If you’re self-employed or a member of a partnership and have been adversely affected by coronavirus (COVID-19), you may have been eligible to claim a grant through the Self-Employment Income Support Scheme.

Keeping Employees Happy in a Post C19 Workplace video chat

Jonathan Walton managing director and Alan Morgan of Whitley Stimpson shared their experience of the ways you can reward your employees via video chat on Thursday 30 July on the B4 Live platform. This included knowledge of the benefits to the workforce and the business, as well as the costs involved.

Rise in HMRC scams reported by the West Midlands Police

In light of the West Midlands Police reporting a rise in HMRC scams, Whitley Stimpson urge you to be wary of suspicious communications.

Why you should be considering R&D Tax Credits video chat

Owen Kyffin and Ian Parker of Whitley Stimpson and Scott Roberts of Polar Technology Management Group discussed why you should consider research and development (R&D) tax credits via video chat on Wednesday 15 July on the B4 Live platform.

Whitley Stimpson announced as a finalist for Accounting Excellence award

Whitley Stimpson have been selected as one of the finalists for the Large Firm of the Year category at the Accounting Excellence Awards 2020, now in their tenth year.

Temporary reduction in VAT announced for hospitality, accommodation and admissions

A temporary reduction in VAT for hospitality, accommodation and admissions has been introduced in response to the coronavirus (COVID-19) pandemic.

Update on the deferral on July payments to January 2021 by Owen Kyffin

The Institute of Tax have provided some further guidance following an HMRC statement.

B4 LIVE: Keeping Employees Happy in a Post C19 Workplace

Employers who look after their staff will come out of the other side of the C19 disaster stronger than ever.

Keeping it in the Family – IHT Planning now and post C19 video chat

Jonathan Walton and Owen Kyffin of Whitley Stimpson discussed inheritance tax (IHT) now and post COVID-19 via video chat on Wednesday 1 July on the B4 Live platform. A recording of this discussion can be found below.

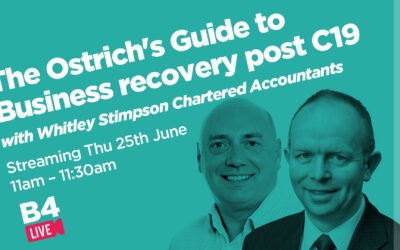

The Ostrich’s Guide to Business recovery post C19 video chat

Jonathan Walton of Whitley Stimpson and Peter Windatt of BRI Business Recovery and Insolvency discussed business recovery post COVID-19 via video chat on Thursday 25 June on the B4 Live platform.

Comments on the deferral on July payments to January 2021 by Owen Kyffin

I have had quite a few confused contacts from clients over the last few days about ‘Payments on Accounts’ – advance payments towards your Self Assessment tax bill, including Class 4 National Insurance if you’re self-employed.

Whitley Stimpson advises businesses to keep to normal filing deadlines if possible

Temporary changes to Companies House filing deadlines have been introduced but it’s more important than ever to have an accurate, up to date picture of where you are as a business, in these difficult financial times.

News

Partners in your progress

When you work with us, you’ll be working alongside a partner and advisor who’s genuinely interested in your success – but it all starts with a conversation.

Whether it's on the phone or over a coffee, we'd love to sit down and talk through any questions you have. Just give us a call, drop us an email, or fill in our contact form, and we'll get back to you as soon as we can.